san francisco payroll tax and gross receipts

Over the next few years the City will phase in the. The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014.

Annual Business Tax Returns 2020 Treasurer Tax Collector

The 2017 gross receipts tax and payroll expense tax return is due February 28 2018.

. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit. Therefore when you register for a San Francisco. Trust And Estate Administration.

Starting with a single payroll tax weve seen a transi. Administrative and Support Services. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons. Proposition F was approved by San Francisco voters on November 3 2020 and became effective January 1. San Francisco imposes a Payroll Expense Tax on the compensation earned for work and services performed within the city.

Entities currently paying a payroll tax under the alternative administrative office taxing regime also will be subject to an. Proposition F fully repeals the Payroll Expense. From imposing a single payroll tax to adding a gross receipts tax on.

San Franciscos Gross Receipts Tax is a tax imposed on gross receipts meaning you dont have to be a profitable business to pay the tax. If you have any questions about the San Francisco gross receipts tax or payroll. The citys gross receipts tax which remains a stealth payroll tax for most companies will become especially confounding as remote work grows.

The city of San Francisco levies a gross receipts tax on the payroll. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. And Miscellaneous Business Activities.

A For all persons required to determine an amount of gross receipts pursuant to this Section that amount shall be all non. The city of San Francisco levies a gross receipts tax on the. An extension can be filed by February 28 2018 to extend the filing due date to May 1.

San Francisco Homelessness Gross Receipts Tax. Gross Receipts Tax Applicable to Private Education and Health Services. All groups and messages.

This tax applies to any entity with employees who work in San Francisco or generate revenues in San Francisco. The Payroll Expense Tax will not be phased out in 2018. Since 2012 San Francisco has undergone many changes with its taxation of payroll and gross receipts.

APPORTIONMENT OF RECEIPTS BASED ON PAYROLL. 200M gross receipts 50 payroll.

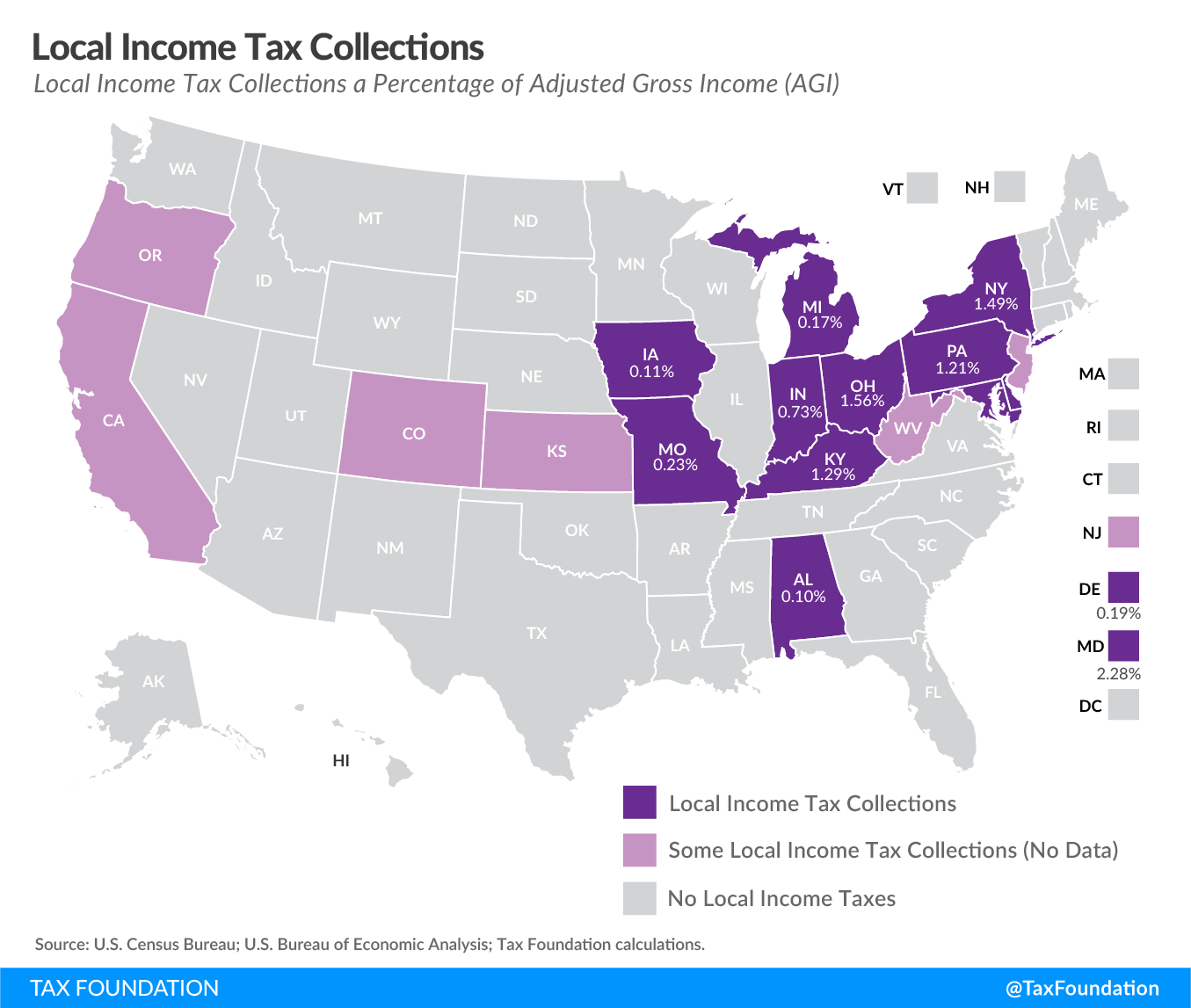

Charts Of The Week Government Reform Municipal Taxes And Teacher Diversity Across The Us

Gross Receipts Tax And Business Registration Fees Ordinance Ppt Download

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

Local Income Taxes In 2019 Local Income Tax City County Level

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

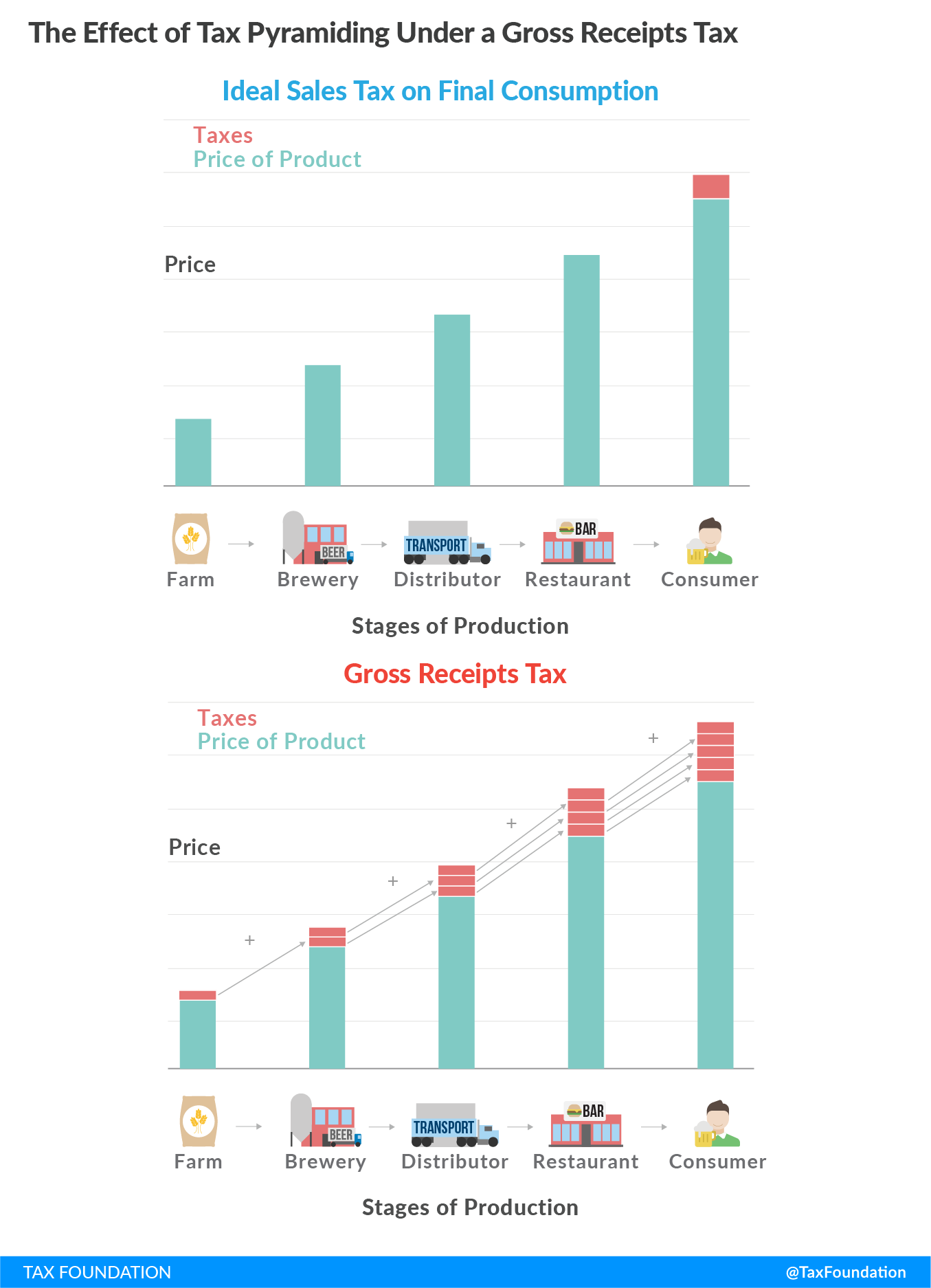

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Employee Retention Tax Credit Can Significantly Reduce Employer Payroll Taxes Lewis Brisbois Bisgaard Smith Llp

San Francisco S Progressive Leaders Ignore Its Everyday Citizens

San Francisco Tax Update Deloitte Us

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

San Francisco Isn T Dying Despite Tech Departures

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

Annual Business Tax Returns 2021 Treasurer Tax Collector

Homelessness Gross Receipts Tax

Are San Francisco Companies Overpaying City Taxes Amid Covid 19 San Francisco Business Times

Gross Receipts Taxes An Assessment Of Their Costs And Consequences

San Francisco Tech Billionaires Go To War Over Homelessness Wired

Overpaid Executive Gross Receipts Tax Approved Jones Day

Employee Retention Tax Credit Extra Cash For Struggling Businesses Singerlewak